FAQs

General Questions

Palo Alto Partners in Education (PiE) is a non-profit education foundation devoted exclusively to raising funds for all PAUSD schools. Powered by a dedicated team of parent volunteers, PiE helps provide important programs and additional instructional staff so that our students can thrive, receive an enriched education and be well prepared for the 21st century. Funds raised by PiE help all 10,320 pre-K through 12th grade PAUSD students in 19 schools.

It is funding from PiE that truly makes the difference between merely a solid education and an excellent one. PiE was created 20 years ago to help address the gap between what Palo Alto families wanted for their children and what state and local funding provided. Because of generous donations to PiE from parents in our community, we have music, art, counseling, and a range of electives to spark student passions. Through PiE, we can fund more than 250 additional adults who provide support throughout PAUSD schools.

A well-rounded education with smaller class sizes and extras such as music, art, science, counseling, etc., is something we want for our kids. When Proposition 13 slashed education funding in California, these programs fell out of the funding equation. This is the case for Palo Alto and for many districts throughout in California. Hundreds of school districts throughout the state have education foundations, like PiE, to supplement the education we want for our students.

While PAUSD is well regarded among California school districts, the fact remains that California is ranked 21st in the nation for per-student funding. Prop 13 limited property tax rates and increases and set assessed values at 1976 levels, unless a property has been sold or expanded through a remodel. Prop 13 effectively cut funding for public schools in California in half.

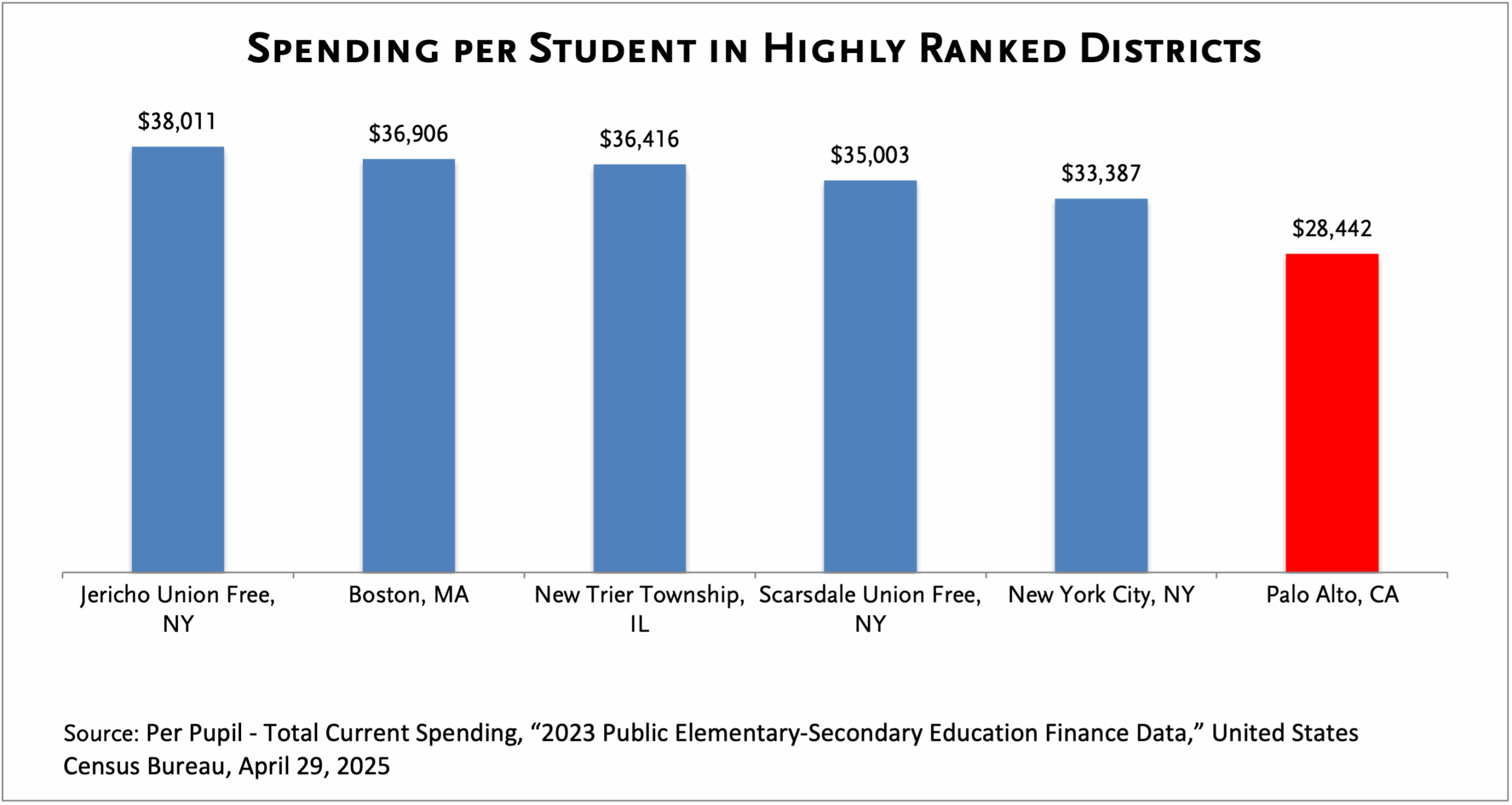

Compared to high performing districts elsewhere in the U.S., (Jericho Union Free, Scarsdale, New Trier, New York) per-student funding in PAUSD is far less than in many of these other top districts.

We encourage people to give an amount that is meaningful to you and your family. Our suggested donation amount is $1,500 per child in the district. If that doesn’t feel like the right amount, please consider giving something that is comfortable. Every dollar makes a difference.

We welcome and encourage gifts of any level so that everyone can participate in the campaign and have a stake in the education of all of our students. Every single gift makes an impact for the students and it truly is a whole community effort to support our schools through PiE. Please join us.

PiE was founded to create programmatic equity among the PAUSD schools. Prior to PiE, PTAs raised funds for classroom aides and additional staff and hired them for their individual schools. Thus, the PTAs that raised a lot of donations had more programs than those that didn't raise as much. In order to make the schools equitable, in 2002 the School Board mandated that funds for staff had to be raised by a district-wide organization and evenly distributed. This led to the formation of an organization called All Schools Fund that later became PiE.

PiE raises funds from PAUSD parents and community members and distributes the funds on a per-pupil basis to each school. As we understand there are varying measures of what constitutes equity, we feel the equal distribution of PiE funds is as equitable as possible. Today, we fund staff members who provide instruction and enrichment as well as social-emotional learning and support at every school. The same opportunities are provided to every student regardless of whether or how much an individual family donates. We do not track how much each school raises.

We are often asked to share funds with the Ravenswood School District. Our mission and our contract with PAUSD explicitly state we can only raise money for PAUSD and that we are the sole organization that can fund staff in PAUSD. While not providing direct funding, PiE works with Ravenswood in other ways. PiE's Executive Director, Erika Buck, is in an Education Foundation Roundtable with the Executive Director of the Ravenswood Education Foundation where they share ideas and best practices. The two also individually meet to discuss the needs of both organizations.

A segment of Ravenswood students are able to attend Palo Alto schools (as well as schools in Belmont-Redwood Shores, Las Lomitas, Menlo Park, Portola Valley, San Carlos and Woodside) through the Tinsley Program, or Voluntary Transfer Program (VTP). Each year, 60 new students in K-2 join the program for Palo Alto and those students stay in the district through 12th grade. Currently, there are about 600 students in the VTP program in Palo Alto. These students receive the full benefit of PiE-funded staff. For many under-represented and impoverished students within PAUSD, exposure to art, music, science labs, counseling, etc., would not be available in the same way without PiE’s funding.

For those who want to direct specific support to PAUSD students in need, there are two foundations that provide scholarships to college-bound graduates of each of the high schools. The focus is on those who are from underprivileged households or are the first in their families to go to college. Learn more by visiting Gunn Foundation and Rise Together Education (Paly).

Not donating to PiE means PiE will have less money to give to each Principal for each student. This affects the Principals’ budgets directly as they will not get extra funding from the District to cover the gap. It means fewer staff to teach and support our kids at each school site. The impact of reduced PiE funding will be felt by students most of all.

If you are upset with an aspect of your child’s education, please communicate your concerns to your teacher, principal, superintendent and/or school board. They all want to ensure your child has access to the best education possible, and is enjoying their school experience.

We undergo an annual independent audit. You can see our Audited Financial Statements and our IRS 990 filings for several years on our PiE Financials webpage. PiE received the highest rating of Platinum from the charity evaluation website GuideStar.

PiE and PTA are both crucial parts of the “funding puzzle” that the district must assemble every year to keep our schools strong. What the two organizations fund are different and do not overlap. Both organizations are needed to elevate the educational experience for the students of Palo Alto.

PiE is the only fundraising organization permitted by the Palo Alto Board of Education to pay for salaries during the school day. PiE is committed to an equitable distribution of funds across PAUSD schools on a per-pupil basis, so that all students benefit.

The PTA supports materials, programs and events at individual school sites. PTA funds such things as classroom enrichment and supplies, school site improvements, playground equipment, student scholarships for field trips, and site-specific programs such as assemblies and parent-run community-building activities. We encourage giving to both PiE and the PTA. To find the PTA website for a specific PAUSD school, please click here to access PTA website.

It is true that houses are very expensive in Palo Alto, however, because of Prop 13, the schools get a limited amount of funding from property taxes. Property owners in high performing districts in other states pay a higher percent of taxes on the value of their house.

PiE funds additional staff in the classroom that public dollars alone cannot provide. We have a hybrid system that combines the public tax dollars with donations from the community. Because of this ongoing partnership, it appears that the schools are well funded, however it is not through property taxes alone.

PiE funds important people who work hard to improve student wellness and teach additional electives—electives which often help students find their passion. PiE is an independent, non-profit education foundation with no influence over the school board and district funding decisions.

PiE works at the school level, by giving individual principals a large portion of their discretionary funding and the flexibility to spend it on additional staff and programs needed for their specific school site—at your child’s school. We can only do that for our students with continued support from the community.

Funding Distribution Questions

Donations to PiE make up an average of 65% of the site-directed funds that each principal has to use for his or her own school. These funds pay for many critical staff that local and state funding does not support. Over 250 additional supportive staff (aides, teachers, specialists, counselors, etc.) are funded in whole or in part by PiE. PiE reviews district financial reports to ensure that funds are spent in accordance with donor wishes.

PiE funds:

Elementary

STEM: Instructors whose hands-on lessons and innovative teaching methods build key skills and ignite student interest in STEM.

The Arts: Art, music, theater, and other performing arts classes ensure a creative and well-rounded curriculum.

Wellness & Support: Supportive staff, including classroom aides, instructional assistants, math specialists, and school-based mental health counselors, who foster, enrich, and help differentiate teaching and learning for all students.

Middle School

STEM and The Arts: Compelling and practical electives focused on STEM and the Arts, such as broadcast video production, marine biology, Money Matters, creative writing, industrial technology, and music, spark students’ interest and build essential 21st century skills.

Wellness & Support: Counselors, mentors, and advisors support social-emotional learning for all students, as well as provide academic guidance, character education, online safety, and next-grade transition programs.

High School

STEM and The Arts: Engaging electives focused on STEM and the Arts, including BEAM (Business, Entrepreneurship, and Mathematics), orchestra, theatre, and broadcast journalism captivate students and build critical thinking skills.

Wellness & Support: Counselors, mentors, and advisors offer emotional and academic guidance as well as help build student resilience. PiE also funds College and Career Counseling advisors who provide individual counseling to help students consider a variety of pathways to success and plan wisely for the future.

For more information about of how PiE funds are being used at the different school levels, or how your donations benefit specific schools, please see How PiE Helps PAUSD Schools.

PiE funds are allocated to every school on a per-pupil basis. Principals apply PiE funds towards staffing the programs that matter most for their students and communities in the following focus areas:

- STEM (Science, Technology, Engineering and Mathematics)

- The Arts

- Wellness and Support

PiE audits how PAUSD uses PiE's grant annually. Each year, the Executive Director reviews a full list of staff members funded by PiE to ensure that the roles receiving funds are the correct ones. PiE does not fund construction, legal services, or school renaming.

PAUSD has around 10,320 students. There are 19 schools in PAUSD—1 young fives and special education preschool program, 12 elementary schools, 3 middle schools, and 2 high schools and 1 Middle College high school.

A PAUSD School Board Policy decision made in 2002 mandates that only a central fundraising organization can pay for supplemental staffing and that it must be funded at the same per-student amount at PAUSD schools. (Please see PAUSD K-12 Staffing Policy for further details.) This “equal funding for all schools” principle is a cornerstone value of PiE, of PAUSD, and of the community in which we operate. PiE cannot change this approach.

PiE strengthens the whole TK-12 experience. The enrichment and support provided to your child this year was made possible by the generous donations made last year. By donating now, you are ensuring the same opportunity is available for all children next year.

No. In the high schools, PiE funds 1. Guidance and Wellness counseling staff, 2. electives teachers for classes in STEM and The Arts, and 3. College and Career counselors. The new Ethnic Studies course is not an elective, nor is it a STEM or Arts class. Thus, it does not fit within PiE’s funding guidelines.

Donation Questions

Yes, to the full extent allowed by law. Palo Alto Partners in Education is a 501(c)(3), nonprofit organization. PiE’s Tax ID # is 77-0186364.

Many employers offer matching donation programs to encourage employees to contribute to charitable organizations. Some will match your contribution dollar for dollar, while others may double or even triple the amount of your donation. The employee must request the match; it’s not something PiE can do for you. Generally, employees can initiate the matching contribution by completing a form on their company’s internal website or through their HR department. To search for your company, please see the Employer Match page. Palo Alto Partners in Education’s EIN (Tax ID #) is 77-0186364.

Some companies invite employees to make a donation through an internal portal so the company can automatically provide a matching gift. If you do this, please tell us! We will note it in our records and will let you know when the gift arrives. Donations and matching gifts made through company websites often take 6-8 weeks to process before we are notified, and some take up to six months! If you let us know you initiated the donation, we won’t continue to send you requests for a gift (only periodic reminders if we don’t receive it from the company).

Gifts of securities (stock) are warmly encouraged and can provide tax benefits to donors (please consult your tax attorney). To transfer appreciated securities, please fill out this form to let us know that you will be transferring and you will receive the instructions via automated email.

For information regarding wire transfers, planned giving or other gifts, including gifts in kind, please call Linda Lyon, Executive Director, at 650-329-3990 or email donations@papie.org.

A Donor-Advised Fund (DAF) is an account that holds and invests money set aside for charitable giving. The donor gets an immediate tax deduction when the funds are transferred to the DAF account instead of when each gift from that fund is made to a charity. The funds can be in cash, stock or other assets.

The fund is held by a nonprofit, called a sponsoring organization, that invests the assets and manages the donor’s account. These sponsoring organizations are often community foundations and nonprofit arms of financial-services firms. Once a fund is established, donors tell the sponsoring organization which charities they’d like to donate to from their accounts.

You should speak with a tax or financial expert about whether a Donor-Advised Fund is a good vehicle for your situation. The explanation above is not meant to serve as advice.

Once you have a DAF, you can make a donation to PiE by logging into your account and request that a grant be made for Palo Alto Partners in Education. Our Tax ID (also called an EIN number) is 77-0186364. If there is an option of whether or not to share your name and contact information with us, please do! That way we can attribute your gift to your record. (If you give anonymously, we get a check with no donor name and don’t know whom to thank!) You will not receive any goods or services for your donation. (They often ask about that.)

The sponsoring organization sends us a check. For some, it comes in a few days. Others can take a few weeks. We’ll let you know when the check arrives. You would have received the tax deduction when you contributed to the DAF so our acknowledgement letter will not have the tax receipt footer on it.

Please call our office at 650-329-3990 or email at donations@papie.org if you have any questions.

We can relate. PiE volunteers are all parents and we face the same issues. This is one of the most expensive areas in which to live, work and raise kids. The cost of providing an excellent, well-rounded education for our kids has gone up everywhere. We understand that families give in many ways and to many causes. Every gift to PiE makes an impact for all of our students by ensuring additional staff is on campus to help our kids during every school day. We welcome and encourage gifts of any and all levels. We’d love to have as much of the whole community as possible supporting all of our students.

Questions about Taxes and California School Funding 101

A public education may be free, but an excellent education is not. Parents, schools, community donors, and PiE must work together to strengthen our schools.

In the U.S., public schools rely primarily on state and local funding. While California used to have the best performing schools in the country, it is now ranked 21st in the U.S. in terms of school funding. Prop 13, which was passed in 1978 to cap the rate and slow the growth of property taxes, effectively cut funding for public schools in California in half.

The Parcel Tax that was renewed through Measure O in November 2020, maintains some of the core funding lost in recent years, however it primarily goes toward salaries, building maintenance, and administration. The Parcel Tax provides $15.9 million annually, but it does not provide for the extras—support and enrichment—that we all expect from a 21st century education for our children.

An important distinction is that the Parcel Tax is designated for particular uses as decided by the District and Board of Education. PiE funding gives individual principals discretionary funding and the flexibility to spend on additional staff and programs needed for their specific school site.

The Bond that was passed by voters through Measure Z in November 2019 provides funds for capital expenses, like building maintenance and facility replacement. It does not provides any funds for staffing, so PiE’s grant to the District is still just as important with the passage of the Bond.

PAUSD did get some funding through Prop 28, but it's restricted to be used for new arts funding over and above what was already being provided. It can't replace who PiE funds. It's also not guaranteed for future years, so the District doesn't want to hire new staff who they may not be able to afford if the funding is stopped. Thus, they are using the Prop 28 dollars to add additional Spectra Art classes this year, supplementing the music in elementary schools, and adding a few sectionals in middle and high schools. For Spectra Art, PiE still pays for the base of 16 classes per school (and some schools already use PiE money to add additional classes, like Ohlone). The Prop 28 money is allowing for an additional 8 classes per school for the 2025-26 school year. PiE must cover the same amount as before. It's just that the kids get an additional benefit from the state funds. That's the same with music—PiE funds the base need of the teachers and accompanists and the state is enabling a slight increase to it, but not replacing the need PiE fills.

The well-rounded education we want for our children that includes extras such as music, art, computer science, etc., requires extra funding. These programs, which used to be funded by property taxes, are simply not a part of the district funding equation these days. This is true in Palo Alto and throughout California. Hundreds of school districts in the state have education foundations like PiE to supplement the above mentioned extras we want for our students.

Although we feel the pinch of high property taxes, we are fortunate in that the high value of our houses drives our tax bill up more than the actual tax rate, which is comparatively low. Interestingly, our property tax rate is much lower than in high performing districts such as Scarsdale, Rye, New Trier, and Princeton, which have property tax rates more than twice as high. These districts are able to spend nearly $10,000 more per child per year.

PAUSD is what is called a Basic Aid district. Because it receives enough local tax revenue to meet the rather low minimum school funding threshold set by the state, it gets little state funding (about 6.4%). While Basic Aid status gives PAUSD more local control over funding decisions, it also means a greater dependence on tax revenue.

Revenue can increase when houses are sold and higher property taxes are collected, however, in order to support the school district’s high standards of excellence, Palo Alto schools rely greatly on the generosity of local donors and parcel taxes to supplement property taxes, and limited state and federal funding.

The primary source of funding for PAUSD is local revenue—mainly property taxes and the Parcel Tax.

- 10,320 students in one unified school district: 1 Young Fives program, 12 Elementary Schools, 3 Middle Schools, 3 High Schools

- Annual budget is just over $340 Million—about 85% of budget is tied to compensation.

- PAUSD revenue sources: local property taxes (83%), other State sources (6.4%), Parcel Tax (4.9%), Federal Revenue (1.1%), lease revenue (1.7%), PiE (1.4%), and other revenue (1.2%).

While PiE dollars make up only 1.4% of the total revenue for PAUSD, they are an average of 65% of the principal-directed funding each school has.

Yes. A well-rounded education includes many extras that are important for our kids today. Programs, which used to be covered by property taxes, are simply not part of the district funding equation these days. This is true for Palo Alto and pretty much every district in California.

PiE’s suggested donation of $1,500 per child is actually lower than the amount asked by many surrounding communities. By comparison, the per-child request in Hillsborough is $3,491, Menlo Park-Atherton is $2,200*, and San Carlos is $2,000*. (*In combination with their parent clubs or PTAs.)

Organizational Questions

PiE is a non-profit educational foundation run by a Board of Directors of dedicated parent volunteers with professional expertise in a variety of areas, including fundraising, finance, development, business, law, and marketing. Strong supporters of Palo Alto’s public schools, PiE Board members understand that a public education is free, but a great education is not. PiE employs a full-time Executive Director as well as two part-time staff members. They can be reached in the PiE office at 650-329-3990 or by sending email to info@papie.org

We presented the schools with a $4.9 million grant and $73,825 in additional PiE Innovation Grants for special innovative and collaborative projects.

Each spring, PiE works to determine the District’s overall level of need through discussions with Principals and other district administrators. The 2025-26 revenue goal is $5.1 million, with $75,000 allocated for PiE Innovation Grants.

It is important to remember that PiE was established and is required to benefit all students.

PiE (or, technically, PiE’s predecessor organization, All Schools Fund) was first created in 2002 after the PAUSD School Board made a ruling that only a centralized fundraising organization can provide funding for staffing. The funds raised by the central fundraising organization must be distributed on a per-student equal basis. Because of this cornerstone founding principle, dictated by the district, PiE is not allowed to raise funds specifically for any subgroup or direct funds to student subgroups from our main campaign—not those with IEPs or those who are Tinsley scholars nor gifted students nor those who are learning English, for example.

At the elementary level, all students have access to art (including some Spectra Art classes taught within the specialized classrooms), music, science and, when in the general education classroom settings, general classroom aides. At the middle and high schools, all students, including those with IEPs, are assigned to guidance counselors (nearly a third of whom are now funded by PiE gifts across the district). These students also participate in elective classes, many of which are funded by PiE.

The one area where PiE has, by tradition, been able to make grants that benefit specific subgroups of students is PiE’s small Innovation Grants program. Since its inception within the PiE predecessor organization, PAFE, more than 30 years ago, the PiE Innovation Grants program has given out over $1.55 million for innovative pilot projects.

PiE wishes to do more to support ALL our students, but we are limited by funds available. So, if you find any of the program benefits mentioned above useful to your child(ren), please consider giving what is meaningful to your family.